Want ROI on GLP-1's and SGLT2i's? Start with Finding the 1 in 4 Employees with Stage B Heart Failure

GLP-1s have become the $100B headline in healthcare. Employers are struggling with paths to sustain and control the costs of covering them, pharmacy costs are spiking, and debates over ROI dominate boardrooms. But here’s the inconvenient truth: without finding the 1 in 4 employees with silent, Stage B heart failure or the millions with early chronic kidney disease - those GLP-1 and SGLT2i dollars are only a small part of the story. We’re medicating the visible problems - weight and diabetes - while ignoring the hidden precursors that drive $30,000–$50,000 heart failure hospitalizations, $90,000+ per year dialysis costs, and billions in lost productivity.

The Hidden Threat Employers Miss

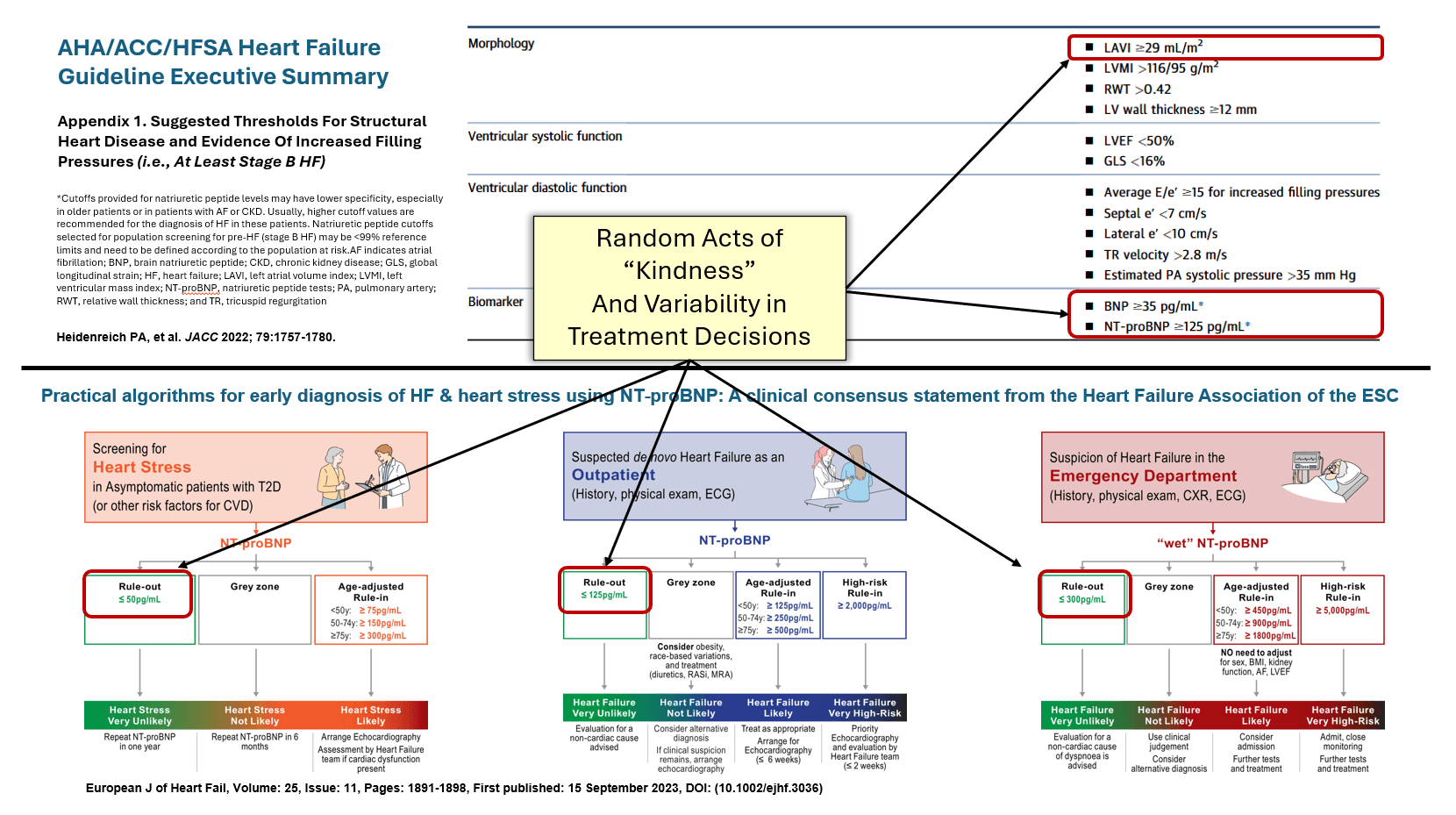

Heart failure doesn’t start in the ICU. It starts quietly, with structural heart changes that most employees and even physicians never see. The AHA calls this Stage B HF (Pre-HF): asymptomatic but measurable disease often shown as Left Atrial Enlargement (LAE), Left Ventricular Hypertrophy (LVH) and increased cardiac filling pressures. These are often linked to obesity, hypertension, or type 2 diabetes and CKD. Additionally, CKD often evolves in parallel, progressing silently until late-stage decline forces dialysis or transplant

- A 2024 Report of CDC’s National Center on Health Statistics showed that nearly half of U.S. adults (47.7%) have hypertension, yet only 20.7% achieve adequate control despite treatment

- Approximately 1 in 4 high-risk adults screened show Stage B HF changes

- Up to 40% of adults with diabetes have CKD, many undiagnosed until late stages

- 60% of CKD patients have at least one structural/functional cardiac abnormality (LVH or diastolic dysfunction), even when asymptomatic

- Hospitalizations cost $30–50k each for HF, while dialysis costs can exceed $90k annually

- Progression is predictable: up to half of Stage B patients develop symptomatic HF within five years; CKD follows similar trajectories

You can only manage what you have measured, yet early detection is abysmal. Primary care misses 50–70% of early HF and CKD cases due to lack of systematic screening. Earlier this year, I nominated “Echocardiography Screening to Prevent Heart Failure” to the USPSTF. Their January 2025 response? Decline. Not because the evidence is weak, but because their agenda is full. Translation: no Medicare, Medicare Advantage, or ACA-mandated coverage, no zero cost-sharing, and no systemic push to act early.

Employers don’t have to wait. Fully insured groups (40–50% of the U.S. commercial market) have the flexibility to cover tests, integrate protocols into wellness programs, and pull prevention forward.

Don’t Over-Index on a Single Lab

BNP and NT-proBNP are valuable signals but poor stand-alone decision makers. Cut-offs vary, results fall into “grey zones,” and clinical response is inconsistent and too often random acts of kindness (also known as variability in care).

In the end, the ROI isn’t in ordering one test. It’s in structured pathways:

- Biomarkers: NT-proBNP for HF stress, UACR/eGFR for CKD

- Handheld screening echocardiography: to confirm structural disease.

- Risk scores: layering diabetes, obesity, hypertension, family history.

- Treatment initiation protocols: tying GLP-1/SGLT2i access directly to risk documentation, bypassing prior-auth bottlenecks.

Employers shouldn’t just subsidize tests. They should subsidize consistency protocolized approaches that turn a low cost urine test (UACR) and a biomarker and and screening echo into a multimillion dollar savings play.

Inverting the Utilization Management Question

GLP-1s and SGLT2is aren’t just diabetes or weight-loss drugs. They are cardio-renal prevention tools. The evidence:

- SGLT2i's cut HF progression and hospitalizations by 20–30% (Class I guideline support)

- GLP-1's in obesity reduce CV events and HF symptoms (SELECT trial)

- Combination therapy may slash HF risk 40–50%.

- ...And this does not contemplate the additional benefits by GLP-1's to reduce Metabolic-Associated Fatty Liver Disease (MAFLD)...an independent predictive risk factor for both heart failure and death

Yet only 10–15% of eligible patients receive them. Why? Sticker shock ($500–$1,300/month), prior auths, and narrow coverage. Employers can flip the script by tying access to early detection. Should we invert the question to say "if a patient has evidence of Stage B HF, why aren't they on an SGLT2i and if obese, has diabetes or evidence of MAFLD, also a GLP-1?"

Why Employers Are the Pivotal Players

Fully insured groups face 7–8% premium hikes and pharmacy spend consuming 25–30% of budgets. GLP-1s already account for 10.5% of claims in 2024, up from 6.9% in 2022. Coverage is expanding, but uneven: 36% of employers cover GLP-1s for both diabetes and obesity; only 20% cover weight management broadly.

Here’s the lever: don’t just say yes or no to GLP-1/SGLT2i coverage. Say "YES" when cardio-renal disease or Stage B HF is detected, diagnosed and a care plan for intervention is defined.

Employer strategies:

- Wellness Integration: Pair NT-proBNP or handheld echo with HRAs; auto-approve GLP-1/SGLT2i for positive screens

- Value-Based PBM Contracts: Demand rebates tied to fewer HF admissions

- Targeted Pilots: Focus on T2DM, CKD, obesity, and hypertension cohorts where Stage B HF prevalence is highest

- Equity Lens: Use telehealth and subsidies to close gaps for underserved employees, where utilization lags 20–40%

A Call to Action

Employers are pouring millions into GLP-1 coverage. The smarter play? Spend $250 or less in diagnostics to find the hidden pre-heart failure and heart failure cases to unlock the real ROI of GLP-1s and SGLT2is.

This is prevention that pays: lower claims, healthier employees, and long-term cost curve bending. USPSTF may lag, but employers don’t have to. The choice is clear—make prevention the default.

Question to readers: If you’re covering GLP-1's and SGLT2i's today and struggling with paths to control cost, what’s stopping you from tying access to Stage B detection? That’s where the real ROI lies.

#HealthcareEconomics #HeartFailure #GLP1 #SGLT2 #EmployerBenefits #ValueBasedCare #CKD #Hypertension #Diabetes #PreventiveCare #ValueBasedCare